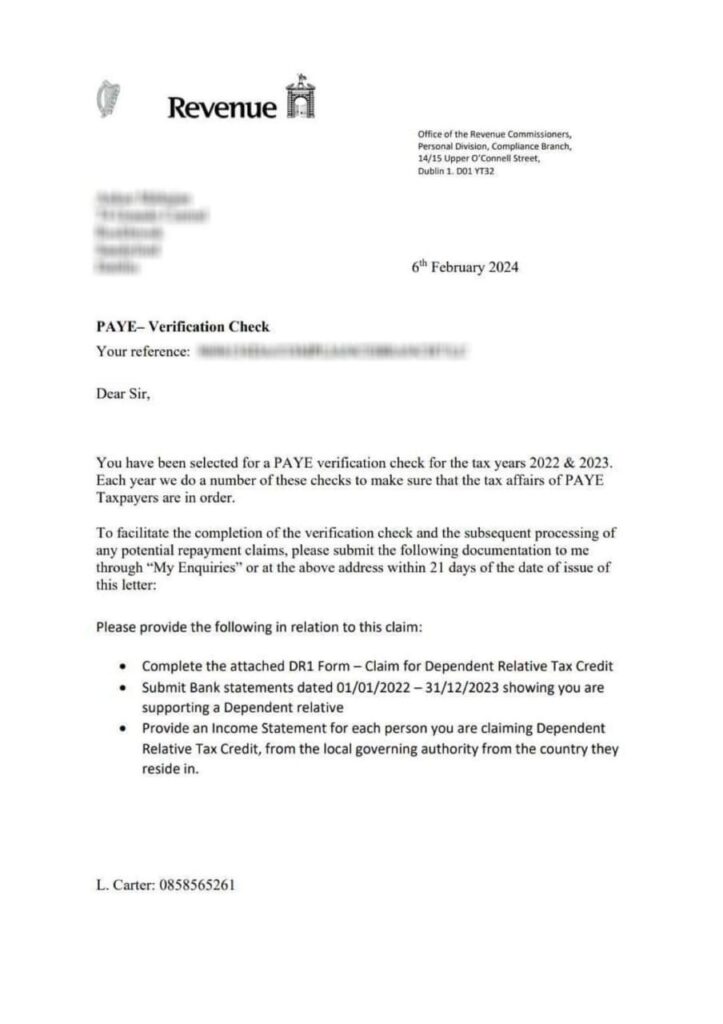

When applying for this dependent relative tax credit in Ireland, the Revenue Commissioners will send you a compliance check letter and ask you to provide the following additional details

1. DR1 Form Completion: You’ll need to fill in this form with details about your parents, including their names, addresses, and annual incomes. This data will be shared with the Indian tax authorities

2. Bank Statements: Revenue will request 12 month of bank statements from all your accounts, both in Ireland and India, to understand your financial situation better and to see the amounts transferred to India. They will also want to make sure that the funds went directly to your parent’s bank account and not your personal accounts. If they funds went directly to your bank account in India, then Revenue will request those bank statements.

3. Income Statements: For each dependent you’re claiming, you will be forced to provide an income statement for each parent. Then the income statement will need to be verified by an Indian accountant, and then the accountant will need to submit your parents Indian tax returns, which will verify they have a low income.

The Irish Revenue Commissioner’s Four-Step Approach:

Level 1. Revenue Enquiry**: Initially, Revenue will request financial statements from you and possibly your spouse to begin their audit.

Level 2. Revenue Audit: During this phase, Revenue spends around six months reviewing your bank statements in detail, preparing questions regarding your finances. They will cross reference your income to your P60 Salary and make sure your income tax return is inline with your bank statements.

Level 3. Revenue Investigation: A senior Revenue officer will send you a formal letter asking for clarifications on specific items in your bank statements.

Level 4. Revenue Prosecution: If Revenue finds evidence of untruthfulness or evasion, they will initiate criminal proceedings without notice and you will have your chance to defend your Dependent Relative Tax Credit in the Irish courts. Professional Assistance: There is an old phrase that my dad told me once. “If you think a professional is expensive, wait till you hire an amateur”

• AFG Forensics, a firm with extensive experience in these matters, advises that upon receiving a Revenue enquiry letter, it’s best to engage a professional accountancy firm licensed to practice in Ireland to represent you in communications with Revenue. This is to ensure that your case is handled properly and to navigate the complexities of the process. This structured approach underscores the importance of thorough documentation and honesty in disclosing financial information when applying for tax credits or during any tax-related proceedings in Ireland.

Feel free to reach out to me, Amit Bansal, Partner at Accountants For Good (AFG) for a 45 minute no obligation phone chat.

https://calendly.com/accountantsforgood/60min?month=2024-02

I am an Irish registered FCA Chartered Accountant with an Irish Practicing licence.

My Linkedin is here https://www.linkedin.com/in/amitkbansal4747/